tesla model y tax credit california

The latest TMC Podcast 17 is now available on YouTube and all major podcast networks. The tax credit also isnt available for those with a taxable income higher than 150000 or 300000 if filing jointly.

Tesla Hikes Price Of Model 3 Model Y By 2 000

Youve Never Met a Vehicle that Looks or Drives Like this.

. Mar 28 2022 at 1249pm ET. Are Any Other Manufacturers Close to. Since SUVs can cost up to 80000 USD and still qualify for the full tax credit both Model Ys will qualify as well including the Performance.

Ad The Electric Side of BMW. Luckily Teslas Model Y vehicles are classified as SUVs and will also classify under the truck vans and SUV portion of the tax credit. We covered EV Tax Credit 20 Model Y 3 Gangbuster Sales Low Model X Demand and California FSD Drama.

The tax credit is not dependent on anything. Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds and 14000 Pounds or More in the year they are placed in service. According to Musks latest tweet the price of the FSD is going to increase from 12000 to 15000 from Sep 5th.

Buyers of Tesla and other EVs could be eligible for federal tax breaks under a new Senate deal. When approved youll get a check of 2000 in your mailbox simple and straight. It is not transferable to another year.

Californias MSRP limit on trucks and SUVs will remain at 60000. Make Model PHEV or BEV Federal Tax Credit As of Jan 1 2020 Eligible for CVRP California CVRP Rebate As of Dec 3 2019 Range miles MSRP MSRP - Fed Calif. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in.

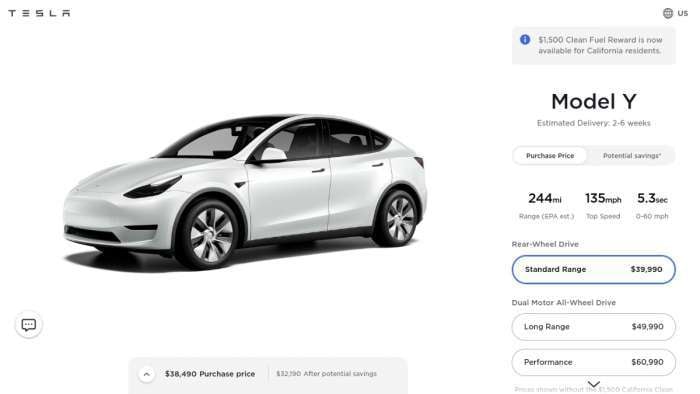

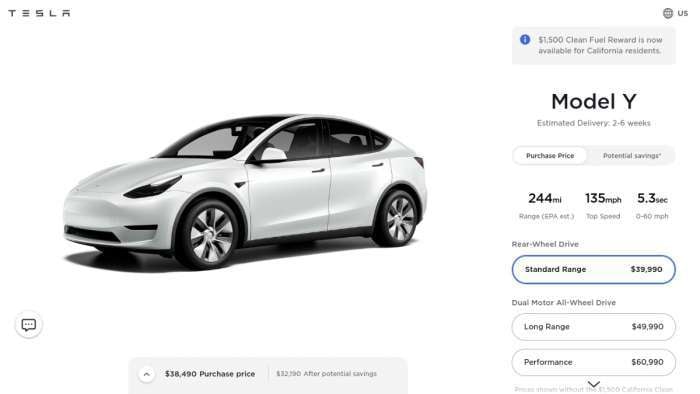

The Model Y starts at 67440 with shipping meeting the 80000 price cap for SUVs under the new subsidy and buyers would likely get the partial 3750 credit because Tesla sources batteries in. Both the Tesla Model 3 and Model Y are now too expensive to qualify for the 2000 CVRP rebate. 1500 tax credit for lease of a new vehicle.

On the website at the time it said there was still a 2000 Federal tax credit available. Select utilities may offer a solar incentive filed on behalf of the customer. Welcome to Tesla Motors Club.

The Tesla Model Y and entry Model 3 still qualify for the rebate but just barely for the former as the CVRP does not take into account destination costs. This is an additional 2000 rebate for which you can apply online. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

Ad Here are some of the tax incentives you can expect if you own an EV car. The US Department of Energy has published a list of vehicles that are eligible for the new EV tax credit until the end of this year. Now when I am filing my taxes through TurboTax it says that the credit is no longer available.

Tesla Model S Performance. Tesla Model Y 179 Deduction. Tesla Model 3 Long Range.

The Inflation Reduction Act could help Tesla TSLA grow into the worlds largest and richest auto company. This is not the end of Cali perks theres another grant named the California Clean Vehicle Rebate Project CVRP and luckily Tesla Model Y and Model 3 both are on the eligible vehicle list. Driving an electric car now comes with added benefits for driving a clean car.

With the recent EV tax credits Im thinking to defer the delivery to the first week of Jan 2023 even though not sure if the Model Y would be eligible with the battery source requirements. That cap is lifted on January 1 2023 so cars tagged as manufacturer sales cap met will not qualify for the electric car tax credit until. You just need to have at least a 7500 tax liability to take full advantage of it.

The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. The misnamed Inflation Reduction Act extends a 7500 tax credit for electric vehicles. For buyers who are eager to purchase an electric vehicle since the law went.

The Model 3 rear-wheel drive is the only Tesla that is currently sold for under 55000. CCFR Customer Terms and Conditions Agreement v3 by Joey Klender on Scribd Tesla buyers in California can. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020.

Typically a married couple needs to earn at least 80k to have a 7500 Federal. Beginning on January 1 2022. Tesla Model S Long Range.

The Plug-In Electric Drive Vehicle Credit 30D provides credit between 2500 and 7500 in nonrefundable tax credit for qualifying vehicles. If you only have 5k tax liability this year you cant use the balance of 2500 for another year. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns.

2500 tax credit for purchase of a new vehicle. Every electric model including Teslas Model 3 Y S and X sold in California still qualifies for a separate incentive administered by the state and utilities that give EV customers a. Luxury Performance in Perfect Harmony.

Tesla cars bought after December 31 2021 would be eligible for. EV Federal Tax Credit for 2021 Tesla. The Terms and Conditions for the 1500 California Clean Fuel Award are available below.

The new law changes which electric vehicles will qualify for the Clean Vehicle Credit. Which I dont understand because I purchased it when it was and couldnt. The bill lifts a tax break cap that excludes EVs made by firms which sell more than 200000 cars per.

The change means that certain vehicles like the Polestar 2 will become ineligible for the rebates. All electric vehicles must have been purchased after December 31 2009 and must acquire their energy from a battery that has a capacity of at least 5 kilowatt-hours. I purchased my Tesla Model Y in late Feb.

The Tesla Model 3 sedan and Model Y crossover are. Since Tesla Model Y is less than 6000 pounds maximum section 179 deduction for Model Y is 10100. Discuss Teslas Model S Model 3 Model X Model Y Cybertruck Roadster and More.

Manufacturer sales cap met. Now only electric vehicles with final assembly in North America will. In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax.

Learn More About BMW Electric Vehicles Now. Expected delivery date is Nov 20-Jan 1 2023.

California Plug In Car Sales Up 79 In 2021 Tesla Model Y 2 Overall

Tesla Brings Back Cheaper Model Y Standard Range But Only In Hong Kong Electrek

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Bumps U S Prices For Model 3 And Model Y The Fast Lane Car

Tesla Is Absolutely Crushing The Competition In California Thanks To The Model Y

Tesla No Longer Eligible For California Rebate Due To Price Increases

Musk Says Tesla Model 3 S Interior Will Feel Like A Spaceship Tesla Model Tesla Car 2018 Tesla Model 3

Tesla Model 3 And Model Y Now Ineligible For The Clean Vehicle Rebate Project Subsidies In California Notebookcheck Net News

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Tesla S Price Increases Pushes Model 3 Model Y Out Of Eligibility For 2 000 California Rebate Carscoops

Tesla Model Y Car Insurance Cost Forbes Advisor

Tesla Model 3 Y Axed From Cvrp Rebate After Price Hikes From Inflation Pressure

Tesla Model Y Has A Heat Pump For Consistent Range In Cold Climates Heat Pump Tesla Model Tesla

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News